The importance of the tiling sector in Spain

Spanish tiles: an ancient tradition

90% of Spanish production is concentrated in the province of Castellón. There are several reasons for this: the particular chemical composition of its clays, the traditional exporting vocation of the region's entrepreneurs in sectors such as citrus, the proximity of the port of Castellón and Valencia, and the fact that, as a result of various unaided conversions, factories have been built with fully automated processes. All this means that the sector is currently growing at a rate of 6%, after years of slower growth.

The evolution of the tile industry

In 2008, due to the crisis that the country is going through, an effort was made to close small factories, as well as a process of consolidation of small companies, which led to the disappearance of some industries that were not competitive, mainly due to their size and high debt levels.

The main European competitor tile manufacturer is Italy.

Having a similar export quota to Spain, and producing in smaller quantities, the average selling price of the finished product is 13.10 euros per m2 for the Italian product, compared to 6.90 euros per m2 for the Spanish product. This is due to the ability of Italian manufacturers to know how to market and add value to the same product, based on the famous Italian model of selling exclusive design and fashion products.

Spain's undisputed leadership

Spain is the world's third largest producer of tiles behind China and Brazil, but in the export rankings it is again in third place, this time behind China and Italy.

China: low quality and not very environmentally friendly in terms of transport

China accounts for 30% of exports, mainly to neighboring countries, with low quality products, in regions where houses are built and left unfinished, and where it is the final buyer who decides which product to use.

Chinese products are manufactured in the southeast of the country, mainly in the Foshan region, where there are more than 3,000 factories and where about 25% of the world's total production is manufactured.

However, Chinese products do not compete on a level playing field due to price dumping, overproduction and lack of quality.

The Iberian Peninsula is a world specialist in tiles

Spain exports its products all over the world, the main customers being the United States, France, Saudi Arabia, Germany and Hong Kong, adapting the products to local tastes. However, 40% of exports are destined for European Union countries.

It is in this market that the Spanish compete with Italian products. 85% of Spanish sales are of red pasta, while Italian production is of white pasta, which means that even though they are of the same quality, they achieve higher sales prices.

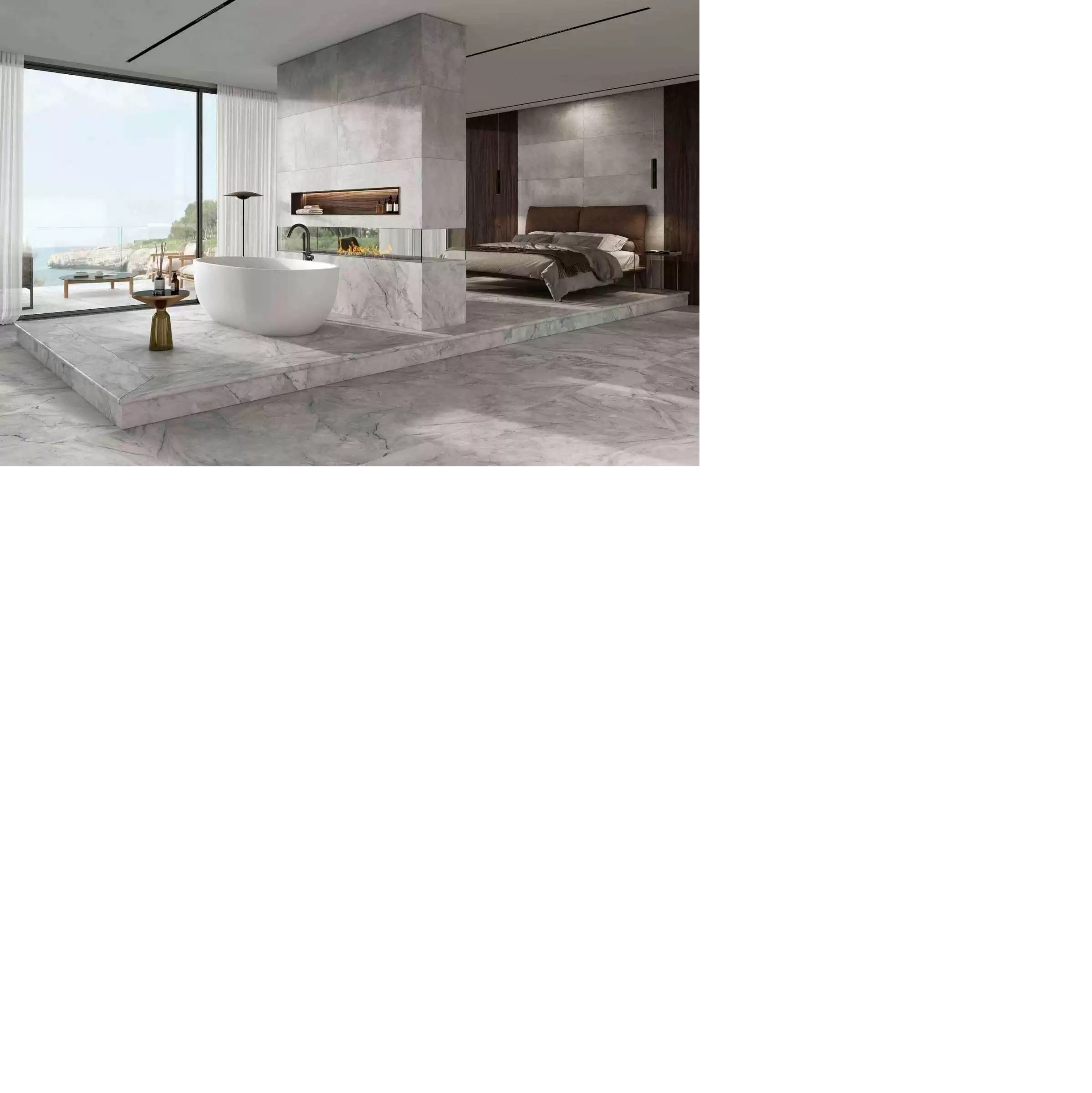

The tile essential in our homes

Ceramic tiles are mainly used in bathrooms and kitchens. The disappearance of the bathtub in favor of the shower tray and the more spacious, open kitchens are helping to sell the product a little more.

The Chinese product is also slowly entering Europe, with lower quality and smaller sizes, but cheaper prices, with which Spain competes in design and large sizes.

The ceramics industry in Spain generates 18,000 direct jobs and approximately 5,000 indirect jobs. There are 208 production centers, 167 of which are located in Castellón.

Some of the major tile brands in the province of Castellon

Among the most important companies, the one that produces the most m2 of tiles is the Pamesa Group, although in terms of sales, Porcelanosa and its subsidiaries have the highest turnover.

This company has been able to have a wide range of products and has opened its own national and international network of stores, which has allowed it to sell at higher prices, to be closer to the final customer, skipping the intermediaries, and to be a brand known for its quality. The group's turnover is close to 800 million euros, compared to 450 million euros for Pamesa.

There are many other companies with significant turnover, such as Argenta, Keraben, Saloni, Aparici, Cifre or Grespania.

Apart from the manufacture of ceramics, there are groups of suppliers to the ceramic industry in the province of Castellón, which are producers of inks and products for tile coating. The most important is the Torrecid Group, which has a turnover of 660 million euros from the sale of its products, and expects double-digit growth due to the quality and demand for its products, which allow tile creations that imitate wood, marble, gold, oxides or aged materials. It has an 8% share of the world market and has opened expansion factories, as well as in Castellón, Italy, Portugal, Asia and Brazil.

Its competitors are Esmalglass, which is half the size of Torrecid, and Ferro, a subsidiary of its U.S. parent company, which has global sales of more than 1 billion euros.

From our perspective, the Spanish are #1.

In summary, in a competitive market, Spain occupies a magnificent position, in all its production modalities, manufacturing products ranging from the use of walls and floors to the manufacture of parts for ventilated facades of buildings. Spain produces red and white paste tiles, and has a high quality clay support and exceptional suppliers for glazes, with advanced and automated production processes, and close logistics for export, without neglecting the domestic market.

Spain is the country of tiles par excellence, with unparalleled quality, competitive prices and unprecedented innovation in design.

It is a sector that has quietly progressed in difficult times.

je souhaite laisser un commentaire